March 2025

If you are thinking of dissolving your fund during 2025, it is important to identify the key dates and plan the timeline for the commencement of the formal solvent voluntary liquidation process if you are aiming to avoid annual fees due to the Cayman Islands Monetary Authority (CIMA) and the Registrar of the Cayman Islands (ROC) for 2026. The key deadlines for completing the stages of the process are set out below.

The process for placing the fund into voluntary liquidation will vary depending on whether type of legal structure. For example, whether the fund is structured as an exempted company (company) or an exempted limited partnership (partnership). We recommend you liaise with legal counsel to ensure that the voluntary liquidation is properly commenced, and a liquidator is appointed.

This note assumes that the fund is solvent and for mutual funds, that all investors have been redeemed or, in the case of private funds, all assets have been liquidated and distributions have been made to investors.

Three key filing and advertising requirements

1. Within 28 days of the company or partnership passing resolutions for the winding up of the entity, documents need to be filed with the Registrar. For a company, the documents are:

- resolution of the shareholder(s);

- notice of the voluntary winding up;

- the voluntary liquidator’s consent to act; and

- the directors declaration of solvency.

For a partnership the notice of the voluntary winding up needs to be filed with the Registrar.

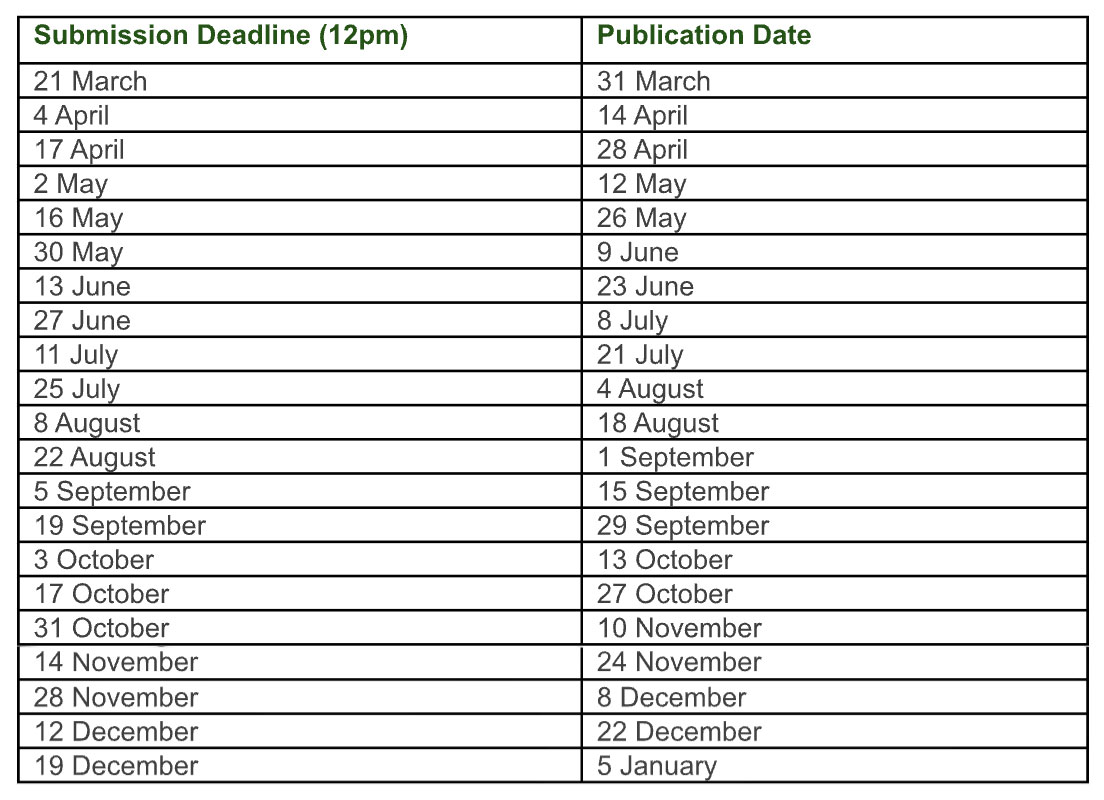

2. In addition, both a company and a partnership commencing voluntary liquidation must place a notice in the Cayman Islands Government Gazette (Gazette). The publication in the Gazette notifies creditors that the voluntary liquidation process has started and the time frame in which they can contact the liquidator to prove their debt or claim against the fund assets. Notices in the Gazette are published every 10 days and must be filed 10 days prior to the publication date by 12pm Cayman time.

3. A fund, whether a partnership or a company registered with CIMA will need to serve notice of the winding up on CIMA to obtain license under liquidation status. The process with CIMA will run alongside the deregistration process of the fund with the Registrar. The following documents must be provided to CIMA:

- resolution of the shareholder(s) or the general partner (as relevant);

- the stamped notice of the voluntary winding up from the Registry;

- an affidavit from the liquidator providing a number of confirmations regarding the operation of the fund; and

- audited accounts from the beginning of the financial year for the company or partnership to the date of the resolution to voluntary liquidate the entity.

In order to finalize the deregistration process with CIMA, the fund will need to have filed all of its audited accounts and Fund Annual Returns for all previous financial years of the fund to the date of the resolution to wind-up the fund. It is important for the fund to confirm it is up to date with all filings before commencing the process.

Gazette filing and publication dates

The key remaining dates for this year whereby notices can be filed for publication are as follows:

Next steps

Exempted limited partnerships

For partnerships there is only one notice which needs to be published in the Gazette; the notice of voluntary liquidation.

Following the 21-day period by which creditors can notify the partnership of any claims, if no claims have been made and there are no assets or liabilities remaining in the partnership, the partnership can be dissolved. Notification of the dissolution must then be made to the Registry.

Exempted companies

For a company, the notification in the Gazette can be a one or two stage process.

Every company must publish a notification of the date of its final general meeting at least 21 days before the final meeting. If the company does not have any assets or liabilities at the time of placing the entity into voluntary liquidation or, if the timing of distributing any assets and paying any liabilities is predictable and not likely to take more than 21 days, then the notification for the final general meeting can take place on the same filing date as the notice of voluntary liquidation.

If the company has assets which are being liquidated as part of the voluntary liquidation process and/or liabilities which are being discharged, it will be important to get the timing right for the final general meeting notice to ensure that by the time of the meeting the company has no assets and no liabilities.

Key Dates

If the meeting needs to occur in 2025, the last date for filing the notice for the final general meeting with the Gazette is 28 November 2025 for publication on 8 December 2025.

If the entity is trying to minimize overheads it should be noted that the Registry fees will not be payable by the entity for the following year, provided that, the notice of voluntary liquidation together with supporting documents, has been filed with the Registry no later than 19 December 2025 and the final general meeting takes place before 31 January 2026.

The fund cannot be dissolved until CIMA has agreed to place the fund into license under liquidation status. Such status should be obtained prior to the 15 January 2026, otherwise the annual CIMA fee will be required to be paid.

Extraordinary Gazette filings can be made if the filing is urgent, and the dates mentioned above have been missed. The Extraordinary Gazette is published on a Wednesday and Friday each week, save for public holidays, and notice documents should be sent to the Gazette at least 2 working days prior to publication in order for it to be processed and published.

How can we help?

If you would like to liquidate your fund this year, please get in touch with us on info@nelsonslegal.com or contact the author of this article, Laura Oseland directly (loseland@nelsonslegal.com) so that we can help you complete the process efficiently and effectively for all stakeholders.

This guide gives a general overview of this topic. It is not legal advice, and you may not rely on it. If you would like legal advice on this topic, please get in touch. Our funds and regulatory team will be happy to assist you with any questions or queries you have regarding your regulatory requirements in the Cayman Islands.